The global trade environment is experiencing extreme volatility spurred by sweeping transformations of U.S. tariff regulations. Issued April 2, 2025, the new policy — “Liberation Day” as the Trump administration labeled it — upended the cost basis and predictability of global trade. Central to the disruption is a two-tiered tariff approach with reciprocal duties, scheduled implementation phases, and a host of new compliance risks.

A Moving Timeline with Real Consequences

The policy’s initial phase, which started April 5th, imposed a 10% reciprocal tariff on imports from the majority of trading partners. A second phase—originally scheduled to start April 9th but postponed to July 9th — will apply country-specific rates enumerated in Annex 1 of the executive order.

China has already been hit with additional measures. On April 9th, the United States imposed a 125% reciprocal tariff on Chinese imports in response to China’s retaliatory tariffs. The tariffs are stacked cumulatively on top of existing duties, such as Section 301 tariffs and IEEPA taxes, creating a high-risk import environment for goods that come from China.

How Exactly Did We Get Here?

January

President Trump pledged to overhaul U.S. trade policy with universal tariffs to protect American workers and families. A week after his inauguration, he announced a 25%+ tariff on semiconductors and pharmaceuticals, targeting the high-tech industry.

February

In early February, President Trump issued Executive Order 14195, which imposed a 10% tariff on all Chinese imports. This was in addition to the existing 20% average tariff from his first term, and these new tariffs took effect almost immediately on February 4th. China quickly retaliated by placing 15% tariffs on U.S. coal, natural gas, oil, and farm equipment by February 10th. They also restricted tungsten exports and launched investigations into American tech companies like Google.

March

The economic challenges continued into March. On March 4th, tariffs on Chinese imports increased from 10% to 20%, impacting $450 billion worth of goods. China retaliated by imposing 10-15% tariffs on American agricultural products like chicken, wheat, and corn. They also suspended lumber imports and revoked soybean licenses from three U.S. companies.

The Reality of Tariff Stacking

One of the most notable reforms is the establishment of “tariff stacking.” It refers to two or more tariffs imposed on the same item simultaneously. For example, a specific product might be subject to the standard U.S. tariff – and also a Section 301 tariff based on Chinese origin, a 20% tax under the IEEPA, and a new reciprocal tax.

That amounts to combined rates of duty potentially greater than 175%. In certain industries, such as electric cars, that figure rises to 245%. These aren’t theoretical costs—they have straightforward consequences for landed cost calculation and sourcing choices.

Exemptions and Annex Clarifications

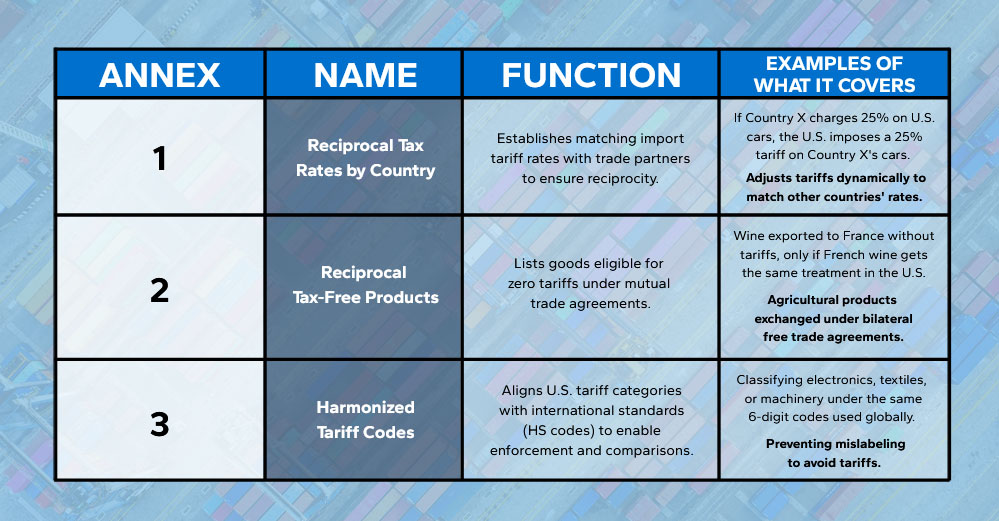

There are minimal relief provisions included in the executive order. Three annexes have the function of setting out the scope and extent of the tariffs.

Correct understanding of these annexes translates into being aware of your products’ HTS classification and making appropriate applications at entry. Misclassification can cause overpayment or non-compliance violation.

Elimination of the De Minimis Rule

Another notable change is the elimination of the de minimis rule for imports from China, Hong Kong, and Macau. Starting May 2nd, goods valued at less than $800 from these places need to be cleared formally if transported by express consignment (e.g., FedEx, UPS). Postal imports remain eligible for de minimis but are taxed at 90% under the new policy.

This change would have disproportionate effects on imports and e-commerce in small packages. Importers need to be prepared to shift to formal or informal entry procedures, which come with additional documentation, valuation, and classification scrutiny.

Sector-Specific Tariff Developments

The reciprocal tax policy leaves some industries out of special treatment. Autos and automobile parts are now subject to a 25% duty under a separate provision. While they are exempt from the new reciprocal tax, the total cost burden is still high.

Meanwhile, certain industries such as pharmaceutical and semiconductor products are already listed under Annex 2 and remain exempt, albeit with growing speculation that they will also be added to tariffs in the near future. Current action adding more electronics to Annex 2 signals enforcement dynamics to shift very quickly, and companies in these industries must prepare for change.

Recommendations for Importers

Because the situation is ever-evolving, importers would be wise to place a premium on transparency and coordination between departments. Some of the considerations are:

- Audit HTS code designations to ensure accurate duty classification

- Collaborate with customs brokers to check entries and explore deferral opportunities (e.g., FTZs, bonded warehouses)

- Develop a landed cost matrix to plot overall tariff impact by supplier and by country

- Revisit contracts and purchase orders to include fluctuating cost structures

The global sourcing landscape is changing, and supply chain visibility is an absolute necessity. It is crucial for effective risk management and cost control and requires tight coordination between the procurement, finance, logistics, and compliance functions.

New Section 301 Maritime Tariffs

Alongside recent tariff policy adjustments, the U.S. Trade Representative published fresh Section 301 sea charges on Chinese operated or built vessels. The charges, laid out under Annex I and II, will immediately impact prices of containerized cargo from October 2025. Though designed to curtail China’s dominance of global shipbuilding, the cost impact will largely accrue to U.S. importers as carriers pass the surcharges downstream.

Annex 1 levies Chinese-crewed vessels a net tonnage (NT) tariff, increasing from $50/NT towards the end of 2025 to $140/NT by 2028. Annex II levies Chinese-built vessels, regardless of owner, a per-container tariff or NT tariff—whichever is greater. Tariffs can be more than $1,600 per container on megaships by 2028. Exemptions for tariff payment are provided for certain ship types and operators that purchase U.S.-built vessels.

These ocean fees are another expense added to the already stretched cost burden of mutual tariffs, IEEPA surcharges, and Section 301 taxes on goods. Bluspark recommends importers begin analyzing routing options, contract provisions, and carrier choice strategies right away to minimize future exposure.

Global Implications and Trade Retaliation

This policy shift isn’t happening in a vacuum. Global retaliation has set in. China has counterattacked with its own 84% duty on U.S. imports. Canada and the EU have also announced retaliatory measures against American products. Simultaneously, developing nations like Vietnam and Bangladesh—while less central to trade imbalances—are being impacted by some of the most punitive reciprocal tax obligations.

This ripple effect can destabilize inflationary patterns and trade flows. Economists project these shifts could cut U.S. GDP growth, increase household costs by nearly $4,000 per year, and reduce global investment in emerging markets.

Looking Ahead

Although the 10% general tariff base and China-specific items are already legislated, more of the overall global architecture remains to come. Country-specific rates in Annex 1 are due to take effect in July. Other adjustments—such as retaliatory tariffs and other policy shifts—may be implemented with prior notice.

Companies that invest in compliance infrastructure and scenario planning now will be in the best position to adapt. In a disordered trading environment, forward-thinking strategy is the ultimate risk management.

At Bluspark, we understand how shifting policies affect your business on the ground. We’re here to provide our clients with timely information, practical solutions, and personalized help with adjusting to these ever-changing shifts to U.S. tariff regulations. Contact us today to receive expert guidance and membership information.

Frequently Asked Questions (FAQs)

What are reciprocal tariffs, and how do they work?

These are duties imposed to mirror the taxes that other countries apply to U.S. exports. They are added on top of existing tariffs, not in place of them.

Is the de minimis rule gone for all imports?

Only for goods coming from China, Hong Kong, and Macau via express carriers. Postal shipments may still qualify but are taxed at 90%.

How do I know if my product is exempt from the reciprocal tax?

Check your harmonized tariff codes against Annex 2. If your item is listed, it may be exempt—but proper classification is essential.

What is tariff stacking?

This is when multiple duties—standard, Section 301, IEEPA, and reciprocal—apply simultaneously, increasing the total tax burden significantly.